Explore the Exam and Question Bank particulars

NISM Series XVI: Commodity Derivatives Mock Test and NISM XVI Question Bank details

The NISM Series XVI – Commodity Derivatives Certification exam covers derivatives products, market regulations, risks, and exchange mechanisms. It’s a multiple-choice online exam with 100 questions, lasting 120 minutes. Passing requires 60% marks with negative marking (-0.25%).

Our expert Content Management team at NISM EXAMS has meticulously crafted a Commodity Derivative Mock Test, featuring a total of 450 important questions, ensuring your comprehensive preparation and success in the exam.

Examination Objectives

Upon successfully completing the examination, candidates should:

Possess a foundational understanding of investments, securities markets, investing in stocks, and comprehension of fixed income securities, derivatives, and mutual funds.

- Understanding various commodity derivatives products.

- Knowledge of regulations governing commodity derivatives markets.

- Awareness of risks associated with commodity derivatives trading.

- Familiarity with exchange mechanisms including trading, clearing, and settlement processes in commodity derivatives markets.

Assessment Structure

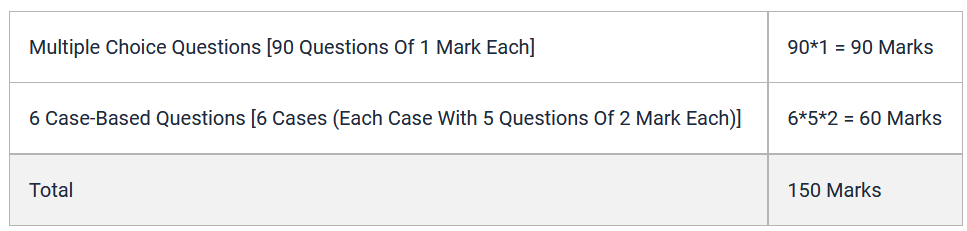

The examination consists of 90 independent multiple choice questions and 6 caselets with 5 questions in each caselet. The assessment structure is as follows:

The exam also includes knowledge proficiencies such as understanding India’s financial structure and the significance of the many regulations and guidelines controlling the securities market in India, particularly those governing the segment of equity derivatives.

WISH YOU ALL THE BEST FOR YOUR EXAM!!