Explore the Exam and Question Bank particulars

NISM Series XIX-C: Alternative Investment Fund Managers Certification and NISM XIX-C Question Bank details

The NISM Series XIX-C: Alternative Investment Fund Managers certification sets a benchmark of knowledge for professionals managing Alternative Investment Funds (AIFs), making it ideal for fund managers, team members, employees of fund management entities involved in the sale, marketing, and administration of AIFs, and industry participants seeking a deeper understanding of AIF regulations and practices. This certification provides a comprehensive understanding of AIFs, emphasizing their management, regulatory requirements, and investment strategies.

Examination Objectives

Upon successful completion of the examination, candidates will:

- Understand Alternative Investment Funds (AIFs): Gain insights into the classification, structures, and operational mechanisms of AIFs.

- Comprehend AIF Market Dynamics: Learn the nuances of portfolio management, investor onboarding, fund marketing, and the challenges of fund-raising and retention.

- Master Regulatory Frameworks:Build proficiency in understanding SEBI guidelines, fund compliance norms, and the fiduciary responsibilities of fund managers.

- Enhance Financial and Tax Knowledge:Grasp the accounting, valuation, and taxation aspects critical to the functioning of AIFs.

- Develop Ethical Practices:Foster a comprehensive understanding of governance and ethical responsibilities in fund management.

Assessment Structure

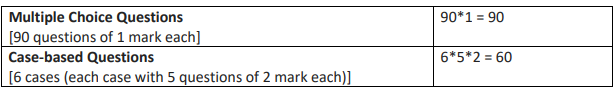

The examination consists of 90 multiple-choice questions and 6 case-based questions (each Case having 5 sub-questions). The examination should be completed in 3 hours. The passing score for the examination is 60% i.e. 90 marks out of 150. There shall be negative marking of 25 percent of the marks assigned to a question. The assessment structure is as follows:

Wish You All The Best For NISM Series XIX-C: Alternative Investment Fund Managers Mock Test & Exam!!!